Introduction - Most forex traders trade the EUR/USD, but most of them fail because they are using technical indicators to guide their trade entries, and these indicators are completely ineffective. This article will show you 6 ways to trade the EUR/USD, without using any technical indicators. Here are 4 ways to trade the EUR/USD to get us started.

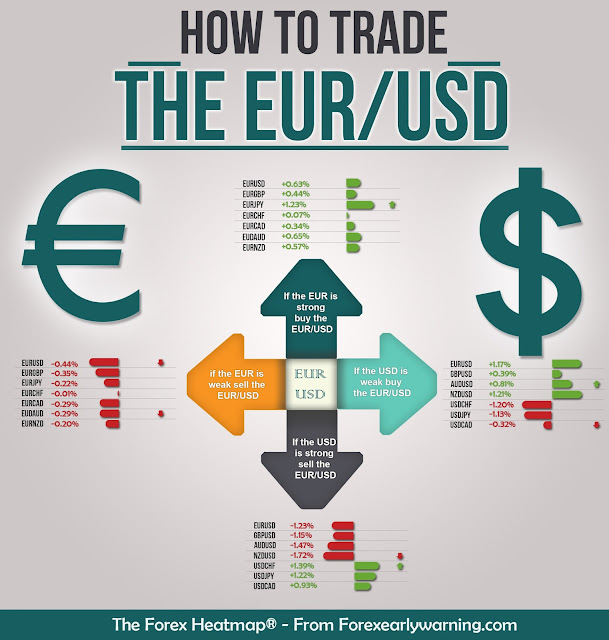

Buying The EUR/USD - When buying the EUR/USD one way to buy it is when the EUR is strengthening, which means the EUR/USD, EUR/JPY, EUR/CAD, EUR/AUD, etc. are all rising. The other way to buy the EUR/USD is when the USD is falling, this would mean the EUR/USD is rising, the USD/CHF is falling the GBP/USD is rising, the USD/JPY is falling, etc.

When buying the EUR/USD another way to buy it is when the USD is weakening, which means the EUR/USD, GBP/USD and AUD/USD would be rising and the USD/CHF would be falling, etc.

Selling the EUR/USD - The other way to sell the EUR/USD is when the USD is rising, this would mean the EUR/USD is falling, the USD/CHF is rising the GBP/USD is falling, the USD/JPY is rising, etc. In this case we are using common sense and other currency pairs to verify the USD strength. Now check the image/info graphic below. Try to visualize all 4 of the above situations.

Similar rules apply when selling the EUR/USD. When selling the EUR/USD one way to sell it is when the EUR is weakening , which means the EUR/USD, EUR/JPY, EUR/CAD, EUR/AUD etc. are all falling.

Two More Ways to Trade the EUR/USD - Another way to buy the EUR/USD is if the EUR is strong and the USD is weak at the same time. When this happens you can get highly profitable trades because in this situation the EUR/USD will move up strongly for the day in forex trading. Price movements can be strong and risk very low when this happens. You can also sell the EUR/USD if the EUR is weak and the USD is strong simultaneously, Once again this is a highly profitable situation for a forex trader.

How Often Do These Trades Occur? - In the main forex session this happens several times per week, sometimes 5 days a week, when one currency is strong and another currency is weak, presenting a profitable trade opportunity. This way of trading has been converted to a real time trading tool called The Forex Heatmap. It may not always be the EUR and USD giving off consistent strength or weakness it may be other currencies. Fore example if the EUR is weak and the NZD is strong you would consider selling the EUR/NZD, but the logic is the same.

Check the above image for an example of EUR weakness on The Forex Heatmap, the EUR is weak and all of the EUR pairs dropped considerably.

A Simpler Way to Trade The EUR/USD - Using these rules and visual indicators to buy or sell the EUR/USD will immediately improve your trading. Visual indicators like the heatmap are simple and logical. Technical indicators are complicated and measure the wrong parameters. Alter you get used to trading the EUR/USD this way you can use the same techniques and tools to trade 28 pairs. At that point your forex tradng will open up to all of the possibilities the forex market has to offer, and your pip totals will increase tremendously.

Conclusions - Forex traders need to move away from ineffective technical indicators and move towards logical forex trading. You can apply the principles used in this article to 28 pairs, then combine it with other trading rules to build a fantastic rules based trading system that is accesibile to all forex traders.